Nepal bets on hydro resource to fuel growth

President tells summit that attracting foreign investment to energy sector is top priority for South Asian country’s economic development

Landlocked Nepal is banking on hydropower to drive the country’s economic growth and it hopes to attract foreign investors to the sector.

The need for foreign investment to develop 40,000 MW of energy in the next 10 years in Nepal — with hydropower being key — was highlighted at a Jan 27-29 summit held in Kathmandu.

Nepal’s President Bidhya Devi Bhandari said attracting foreign investment to the hydropower sector is the country’s top priority.

“In the wake of major political change in the country, our main goal is to achieve rapid economic growth,” she said at the opening ceremony of the Nepal Power Investment Summit 2018. “We need to develop infrastructure to promote our economic development. Harnessing hydropower is an infrastructure development and constitutes a base for prosperity.”

The summit organized by Nepal’s Energy Development Council (EDC) aimed to highlight hydropower’s role in the development of the country’s power sector.

This was the event’s second year and it was attended by government officials, ambassadors, industry leaders, investors and academic researchers from China, South Korea, Japan, India, Europe and the United States. China Daily is a media partner of the summit.

Noting the need to develop renewable energy in the context of climate change and excessive use of fossil fuels, Bhandari said Nepal’s hydro resource is a “valuable gift of nature” as hydroelectricity is one of the most eco-friendly and sustainable sources of energy.

But Nepal’s hydro resource is far from being fully utilized, she said. Compared with a hydro potential of 83,000 MW, the country has a production capacity of only around 1,000 MW, suggesting that 99 percent of its resources are yet to be developed.

Nepal is endowed with a large number of high mountains with plenty of glaciers leading out to more than 6,000 rivers.

EDC chairperson Sujit Acharya said there is a need to develop 40,000 MW in the next 10 years through the country’s abundant natural resources.

“We predict Nepal to be the top destination in South Asia — not only to invest in Nepal’s power infrastructure, but also to use Nepal as the most beneficial destination to export to the world’s largest consumer market, that is South Asia and China with 3 billion estimated consumers,” Acharya said.

Bhandari called on both local and foreign investors to be actively involved in Nepal’s hydropower sector.

“The government is committed to creating a congenial atmosphere for investment by taking due consideration of the investors’ interest and real needs,” she said, adding that capital, technology, market feasibility and development of cross-border transmission lines will be needed for the implementation of large-scale projects.

Deepak Rauniar, CEO of Nepal’s Employees Provident Fund (EPF), said the financial institution aims to invest more in the power sector.

With over 550,000 members, comprising employees from the government, public and private sectors, the EPF manages a total fund of 256 billion Nepali rupees (US$2.5 billion). Rauniar said most of it is put into long-term investments, such as the power sector and airlines, in line with its members’ retirement needs.

One of the EPF’s major investments is the 680 MW Betan Karnali hydropower project. With an initial cost of 80 billion Nepali rupees, the project is expected to complete its feasibility study in the next 16 months and undertake construction within five years. Around a 40 percent share of the project will be offered to EPF members, said Rauniar.

Pointing to the good opportunities offered by the sector, President Bhandari said: “I believe the development of hydropower in Nepal would benefit the neighboring countries as well, and would eventually contribute to economic development of the region.”

Nepal has been working to create an investment-friendly environment, including offering many preferential policies and providing tax exemptions for foreign investment. It encourages foreign investment, either as joint-venture operations with Nepalese investors or as 100 percent foreign-owned enterprises.

“The government will accord top priority to attract foreign investment in hydropower,” said Bhandari.

Tan Ding, managing director of China’s State-owned Hunan Construction Engineering Group (HNCEG), said the China-led Belt and Road Initiative can lead to win-win cooperation in Nepal’s power sector.

The initiative was proposed by Chinese President Xi Jinping in 2013 with the aim of expanding connections between Asia and the rest of the world through trade, investment and infrastructure along the ancient Silk Road routes.

For one of HNCEG’s power projects in Ghana, West Africa, more than 95 percent of the staff were employed locally. This helped speed up integration with local communities. “The localization strategy enhanced the communication and coordination between HNCEG, the local government and people,” said Tan.

“(Training local workers) can also provide an effective protection for the project’s follow-up management and maintenance,” said Tan, who expects the company to further expand its power investment to Nepal in the near future.

Rajat Misra, principal private sector operations specialist at the Asian Infrastructure Investment Bank (AIIB), said the bank was set up to complement existing institutions and address Asia’s development needs by focusing on infrastructure project financing.

With a mission to improve social and economic outcomes in Asia and beyond, the Beijing-headquartered multilateral development bank was formed on China’s initiative.

According to Misra, the bank reached US$4.2 billion in loans and equity investments in the fourth quarter of 2017. Among all the projects it has funded, the energy sector is one of its major focuses, with a share of around 45 percent.

“Multilateral banks are uniquely placed to accelerate sustainable infrastructure investments,” said Misra.

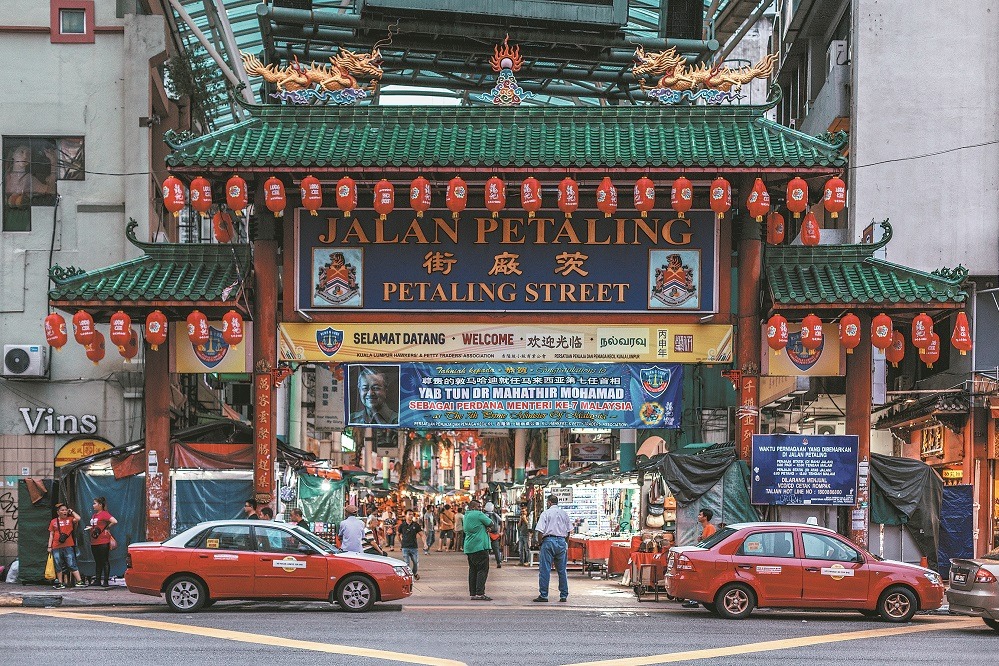

Suthiphand Chirathivat, executive director of the ASEAN Studies Center at Thailand’s Chulalongkorn University, shared his views on regional cooperation in the power sector.

He said the Association of Southeast Asian Nations (ASEAN), which includes Thailand, “has good potential to further harness renewable energy, especially hydro, geothermal, biogas, wind and solar power”.

Noting that most ASEAN countries have set individual targets and support schemes which directly support the regional market, Suthiphand said the establishment of the ASEAN Power Market Integration can offer its members better access to various energy and geographic locations.

“In the ASEAN context, complete consolidation of power systems is impractical. (It is) not only because of geographical factors, but because complete consolidation would mean the establishment of a single market operator with authority that stretches across multiple jurisdictions, requiring changes in rational law,” he said.

For ASEAN, coordination is a more preferable option for power market integration, Suthiphand said. He suggested that Nepal could serve as a power trading hub in the region to boost its long-term development.

Nepal’s former prime minister, KP Sharma Oli, noted that regional cooperation in energy is also about energy trading in South Asia. “We should create an environment for energy trade also under the spirit of the South Asian Free Trade Area and create regional energy infrastructure to facilitate the power trade,” he said.

Oli urged investors to participate in Nepal’s power sector through joint ventures, arrangements such as build-own-operate-transfer, engineering-procurement-construction, and other models.

kelly@chinadailyapac.com