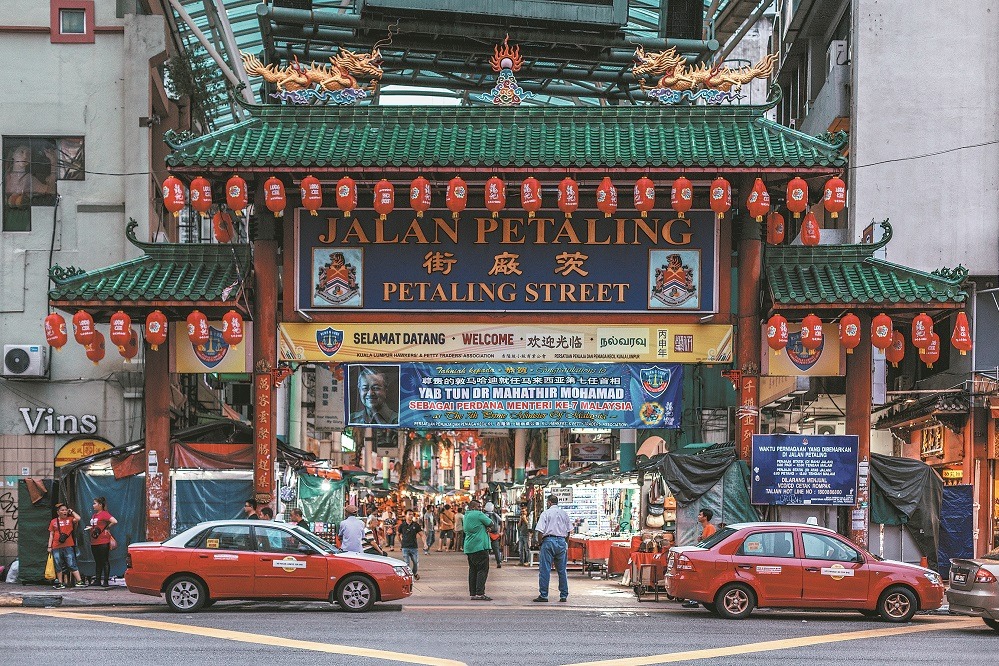

US investors betting that trade deal will be made with China

US investment in China more than doubled in January, an apparent bet that talks between leaders of the world's two largest economies will soon reach a deal to avert a wider trade dispute.

Total foreign direct investment (FDI) in China rose 2.8 percent from a year earlier to $12.41 billion, while US investment grew 124.6 percent, the Ministry of Commerce said.

"We view US foreign direct investment into China as a longer-term vote of confidence," said Ben Phillips, chief investment officer for EventShares in Newport Beach, California.

"Both countries are incentivized to make a partnership work. There are deep structural issues between the two countries. As long as leaders continue to make progress, we remain long-term positive," he told China Daily in an email.

FDI is the accumulated foreign investment in domestic companies or entities in non-financial sectors in a given year.

Failure to reach a trade agreement means US tariffs on Chinese imports valued at about $200 billion would increase to 25 percent from 10 percent on March 2. The higher tariffs would make Chinese products prohibitively expensive in the US.

On Friday, US President Donald Trump repeated that he may extend a March 1 deadline for a deal and keep tariffs on Chinese goods from rising. Speaking at a White House news conference, he said the United States was closer than ever to "having a real trade deal" with China and said he would be "honored" to remove tariffs if an agreement can be reached. But he added that the talks were "very complicated".

US markets were closed on Monday in observance of Presidents Day. Progress in the trade talks helped send world stock markets broadly higher on Friday. Analysts said that the talks continuing next week in Washington have raised hopes that a resolution is near.

On Friday, the Dow Jones Industrial Average jumped 443.86 points to 25,883.25. The S&P 500 gained 1.1 percent to close at 2776.60, led by the energy and industrials sectors. The Nasdaq Composite advanced 0.6 percent to end the day at 7472.41.

"US equities are trading higher on optimism a trade deal is being ironed out as President Trump alluded that the March 1 deadline could be extended," Brendan Ahern, chief investment officer for Krane Funds Advisors in New York, said in an email.

"The trade war has become an overhang for US equities, as US multinational corporations feel the effect of tariffs on imported goods. Global supply chains have been disrupted due to the trade war, which is affecting global growth. A de-escalation would provide a strong tailwind for US and Chinese equities."

Daniel J. Ikenson, director of the Herbert A. Stiefel Center for Trade Policy Studies at the Cato Institute in Washington, said not too much can be determined from a single month's cash flow.

"It would be unwise to assign much meaning to the figure," Ikenson said in an email. "Monthly flows are unreliable predictors of trends because the total value can be affected by a single transaction. It could reflect the decision of one US company to purchase, build, or expand operations in China and mask divestments occurring across a range of companies and industries."

Foreign investors, including those from the UK and the Netherlands, also placed bets in January on Chinese information services, design services, and research and development.

Morgan Stanley expects China's net inflows to range between $110 billion to $230 billion per year in 2019-2030 compared with $126 billion in the last decade.

"I don't know that the information itself is a vote of confidence on the 'trade war' resolving itself," emailed Kevin Carter, founder of the EMQQ, the Emerging Markets Internet & Ecommerce exchange-traded fund. "I think it is more a testament to how intertwined our two economies are. Furthermore, while it is likely that the current situation was factored in by the parties doing the investing, these are investments that materialize over months and years."

Minyuan Zhao, associate professor of management at the University of Pennsylvania's Wharton School, also was cautious.

"Foreign direct investment is often a strategy to jump over trade hurdles," Zhao said in an email. "When cross-border transaction becomes more costly, or risky, companies may decide to engage in more local production, hence higher investments in the host countries. The high investment numbers certainly indicate the importance of the Chinese market, but may not indicate optimism towards the US-China relationship."

Contact the writer at scottreeves@chinadailyusa.com