Greater role of financial opening-up highlighted

Chinese policymakers are attaching greater importance to broadening all-around financial opening-up as a key driving force of China's new growth paradigm, while stressing continued financial stability amid global economic uncertainties caused by the COVID-19 pandemic.

Economic and financial policies should remain supportive to sustain the recovery and growth of the world's second-largest economy, through leveraging outbound capital resources and expanding market access. Meanwhile, tight financial regulations should help counter the risks of excessive speculation, financial bubbles and fraudulent investment, officials and experts said at a summit over the weekend.

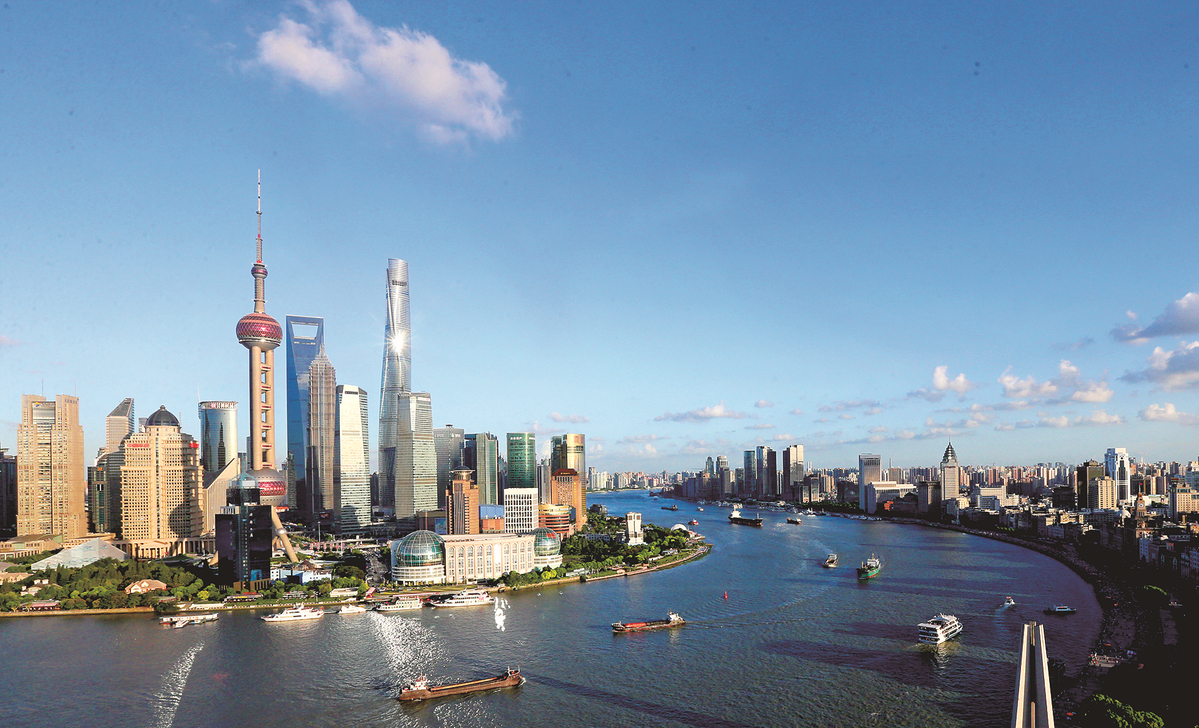

Further opening-up of the financial sector is necessary for building a "new development paradigm", which will attract more foreign institutions, increase business opportunities and enrich financial products. It will also promote the domestic financial system and strengthen financial services in supporting the real economy, Yi Gang, governor of the People's Bank of China, the central bank, said in a video address at the opening ceremony of the 2020 Bund Summit in Shanghai on Saturday.

The country will treat foreign financial institutions and domestic companies equally in business license issuance, and use a negative list to manage investors, which is called the "pre-establishment national treatment and negative list" management system, Yi said.

The central bank governor pledged to push forward financial opening-up along with reform of the renminbi exchange rate regime, and promote market-oriented internationalization of the currency.

The reform will enhance flexibility of the renminbi exchange rate, and the rate should play a role as an "automatic stabilizer" of economic growth and the balance of international payments. Regulators should ease controls on cross-border usage of the renminbi, following market rules, and renminbi internationalization should be a "natural tendency", he said.

China's leadership has explained the "new development paradigm "as a model that shifts economic growth drivers from factors of production to innovation, and from investment alone to both consumption and investment.

Given the ongoing drastic changes in the global financial and economic environment, China needs to take more flexible measures to tackle risks and challenges in developing the domestic financial market, and to seek innovation at the same time, Vice-President Wang Qishan said in a video speech at the summit.

Wang called for preventing and defusing financial risks related to speculative activities, financial bubbles and Ponzi schemes, and strengthening financial regulations during the process as China accelerates the establishment of the new development paradigm.

Ray Dalio, founder, co-chief investment officer and co-chairman of Bridgewater Associates, said, "As China opens its capital markets, it will find favorable capital flows because the fundamentals of investing in China are strong."

He said it is now the right time for China to internationalize the RMB and develop financial centers.

Structural reforms and deepened opening-up will rebalance and facilitate China's economy in the post-COVID period, which will also fuel the global economic recovery, according to experts.

International Monetary Fund Deputy Managing Director Zhang Tao said at the Bund Summit that countries in the Asia-Pacific region should implement supportive monetary and financial policies, while reducing vulnerability in the corporate and financial sectors, as they tackle the challenges brought by the COVID-19 pandemic.

More fiscal support

The government should provide more targeted fiscal support to the most vulnerable in society, by taking measures such as strengthening the healthcare and social security systems, and curbing the intensification of income inequality, according to Zhang.

The IMF has revised up China's GDP growth projection for 2020 from 1 percent to 1.9 percent. China's economic recovery will provide strong driving forces for growth in the Asia-Pacific region and make a great contribution to economic recovery in other regions, he added.

Rapid economic recovery in the first three quarters in China has strengthened foreign investors' confidence in the nation's economic fundamentals. From January to September, foreign investors have increased their holdings of interbank-market bonds by 719.1 billion yuan ($107.57 billion), according to data from the PBOC.

FTSE Russell, a global multi-asset index provider, announced that it will consider adding Chinese government bonds to its flagship World Government Bond Index from October 2021.

Since 2018, eight foreign securities companies, two foreign fund management companies, and 20 private securities investment fund managers have entered China's market, the central bank said.