Great expectations

Adjustment of development paradigm brings with it new demands for improvement of the capital market

Over the past 30 years, remarkable achievements have been made in China's capital market, and it has become more market-oriented, law-based and international.

First, it has supported the development of the market economy. By the end of October 2020, there were 4,082 companies listed on the Shanghai and Shenzhen stock exchanges, with a total market cap of about 73 trillion yuan ($11.2 trillion).They have been instrumental in supporting the real economy.

Over the past 30 years, listed companies have raised more than 15 trillion yuan through equity financing in the capital market.

This has enabled businesses to reinvent themselves in accordance with the standards of public companies, made clear asset ownership, and improved the corporate governance structure, which is of exemplary importance. At present, A-share listed companies cover all 90 industries in the national economy. In 2020, 124 Chinese companies were listed among the Fortune Global 500, of which more than 70 are listed in the A-share market. Almost all leading companies in different sectors in China are listed companies.

Second, the legal framework for the capital market has been greatly improved. Over the past 30 years, improvement of the legal framework has been prioritized, and a capital market framework that adopts international practices and takes into account China's national realities has been gradually established. A legal framework has been established based on the Securities Law, the Fund Law and the Regulations on the Administration of Futures Trading, with department regulations and normative documents as the mainstay.

Third, the capital market has become increasingly international with the opening-up of China's financial sector.

Initially, China's capital market only allowed domestic investors before the Qualified Foreign Institutional Investors program was introduced. Then the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect were launched. There has been a growing proportion of overseas investors holding Chinese stocks, bonds, futures and other financial assets, and investment channels and product choices have become more diversified.

The foreign ownership cap in securities, fund and futures companies has been completely lifted by Dec 1,2020. Foreign private equity funds are now able to operate in China.

The new dual circulation development paradigm brings with it new and greater expectations of the capital market.

First, it must function better in turning savings into capital and optimize the long-term financing structure dominated by indirect financing. A healthy capital market not only increases capital supply, but also multiplies wealth. With China's per capita GDP surpassing $10,000 and more than 400 million people categorized as middle-income, there is huge potential for the capital market in the accumulation and redistribution of wealth.

Second, the capital market needs to be more efficient in capital allocation and better at promoting innovation. It needs to be more efficient in resource allocation, stimulate the innovation vitality of market players, accelerate the commercialization of scientific and technological results, and promote the close integration between technology, capital, and industries.

Third, it needs to better serve its value discovery purpose. It should be able to formulate reasonable asset pricing to make direct financing more attractive, so that more industry-leading businesses with core technologies and innovation capacity may stand out in the capital market. It should promote fair and healthy market competition by constantly improving institutional arrangements such as refinancing, mergers and acquisitions, equity incentives and eliminating inefficient supply and backward production capacity, so that the market can adjust its own operations. It should also access international capital more effectively and ultimately enable Chinese companies greater competitiveness internationally.

I have four suggestions for the healthy development of the capital market.

First, strengthen basic institutional building. In the 14th Five-Year Plan period (2021-25), it is proposed that "we should fully implement the registration system for stock issuance and establish a regular delisting mechanism", which is an important first step for institutional building and will drive a series of basic institutional reforms regarding stock issuance, IPOs, trading and ongoing supervision. We must improve the credit regime and severely punish dishonest behaviors, so as to level the playing field and boost confidence in the market.

Second, standardize the bond market. Since the beginning of this year, the bond market has provided strong support for pandemic prevention and control as well as economic and social development. Bond market financing now accounts for nearly one-fourth of all financing. Since there are still shortcomings to be overcome in China's bond market, we must harmonize regulations for the bond market and promote its connectivity and infrastructure building. We must improve the bond issuance mechanism so that we can be more efficient in bond issuance and bring down management and operation costs. It is necessary to diversify the bond market, further improve market discipline and disincentives, nurture qualified institutional investors, and increase the volume of market transactions.

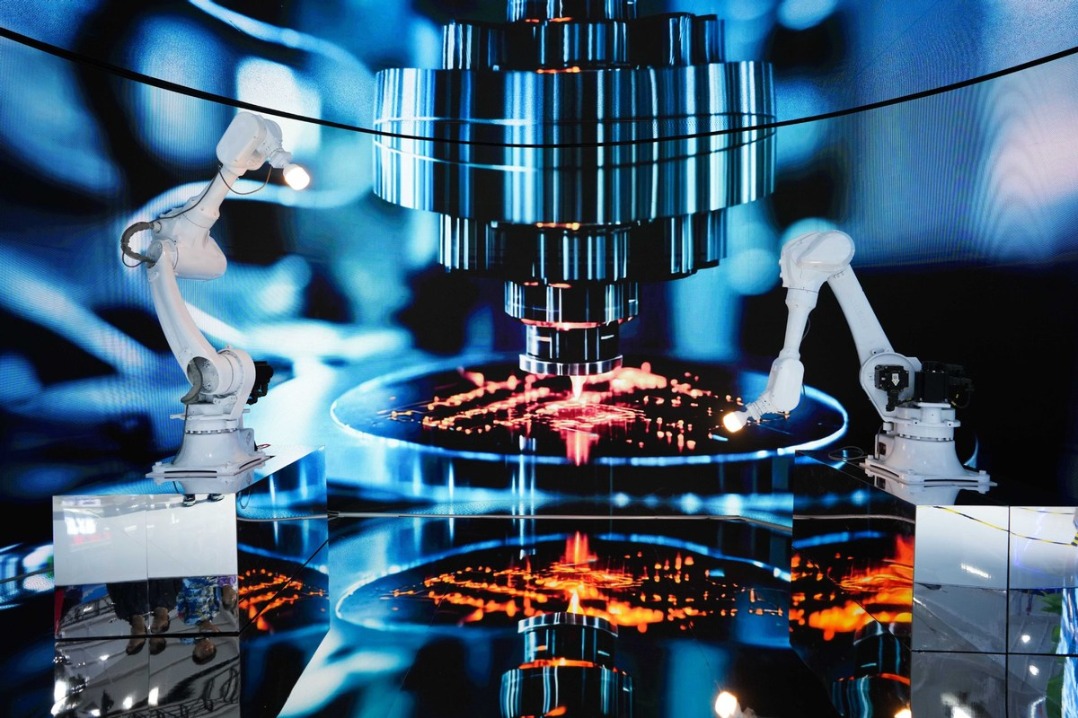

Third, boost the application of technology. At present, technologies such as big data, cloud computing, artificial intelligence and blockchain have been widely used in the securities and futures markets. The application of technology and digital transformation of the capital market should be promoted. Financial services, especially inclusive finance, should be promoted through technological empowerment. Also, information systems and technologies must be more reliable with better institutional design of data standards and data security.

Fourth, continuously improve regulation and create synergy between the regulatory authorities, industry associations, self-discipline of market players and public oversight so as to build a more open, fair and just capital market. The key is to properly handle the relationship between development and security as well as the government and market.

The author is the chairman of the Economic Committee of the National Committee of the Chinese People's Political Consultative Conference and the chairman of the China Wealth Management 50 Forum. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

If you have a specific expertise and would like to contribute to China Daily, please contact us at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.