US debt, FDI in China tell a curious tale

The US Federal Reserve has slowed its interest rate hike tempo over the past two years and even indicated that it may cut rates this year.

The downtrend of US interest rate movement has eased global capital shortages to a certain extent, although it remains a serious problem for economies, including China.

In 2022, faced with resurgent inflation, the Fed embarked on an aggressive path of interest rate increases, raising it seven times by a total of 425 basis points through the year. The move, coupled with tightening expectations, saw US Treasury yields soar, leading to a dollar shortage in other countries and a "double whammy" for the global markets — both stocks and bonds tumbled as international capital rushed back into the United States.

The scenario changed in 2023. With inflation showing signs of easing, the Fed slowed its pace of tightening, raising rates only four times by a total of 100 basis points. In December, it hinted at a potential end to rate hikes and even possible rate cuts. The changing stance has seen Treasury yields retreat from their highs.

As a result, global stocks and bonds rallied as the scale of international capital flowing back into the US decreased, indicating at least a partial easing of the global dollar shortage.

Shortage persists

Foreign investor holdings of US Treasury increased significantly in 2023, reaching a record high of more than $8 trillion by the year-end. In November and December each, foreign investor holdings of US Treasury increased by $240 billion month-on-month, although the sharp increases were primarily due to falling Treasury rates, not a real surge in foreign purchases.

In terms of broad international capital inflows into the US (excluding direct investment), the net inflows of international capital into the country totaled $864.5 billion in 2023, down 46.6 percent year-on-year, but was still the fifth-highest level in history.

In the fourth quarter of 2023, net foreign purchases of US debt stood at $76.7 billion, down 17.6 percent quarter-on-quarter. However, in the same period, the net international capital inflows into the US were $277.6 billion, an increase of 11.4 percent quarter-on-quarter.

Therefore, while there are signs of shifting sentiment among global investors, it is immature to claim that the global dollar shortage has substantially eased.

China cuts holdings

According to data from the US Department of the Treasury, as of end-2023, Chinese investors held $816.3 billion in US debt, a decrease of $50.8 billion year-on-year. It marks the third consecutive year of decline, with a decrease speed of 70.7 percent compared to a year ago.

In the last two months of 2023, Chinese holdings of US debt saw consecutive increases, but it was not the result of increased investment but a substantial decline in Treasury rates and the resulting valuation effect.

As of end-June 2023, China's net nongovernment equity investment in the US was $237.9 billion, up 63.8 percent compared with the end of 2017, according to statistics of the State Administration of Foreign Exchange. Despite the increases, however, the US only accounted for 22 percent of China's holding of outbound securities investment at the end of June, down by 7.2 percentage points from the end of 2017.

The latest statistics on the asset structure of China's banking sector also point to a similar trajectory. As of the end of September, US dollar assets accounted for 58 percent and 74.2 percent of China's overall external financial assets and foreign currency assets, respectively, down 10 and 2.5 percentage points from the end of 2017.

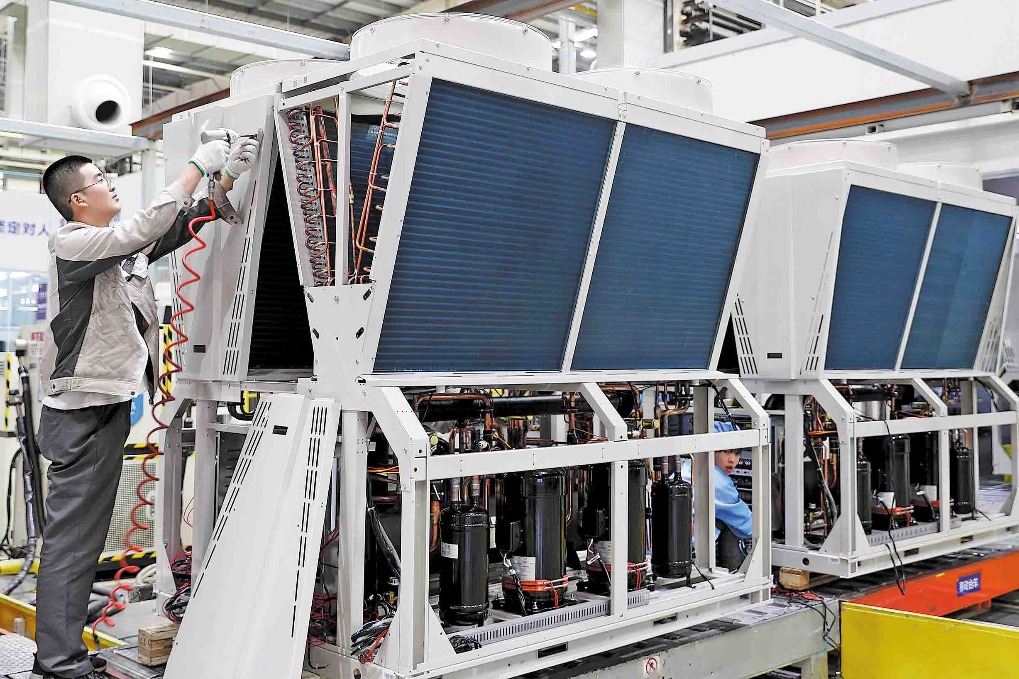

FDI rebounds in Q4

Data from SAFE show that in the fourth quarter of 2023, foreign direct investment in China surged back into surplus territory, registering a notable $17.5 billion surplus, compared with a deficit of $11.8 billion in the previous quarter.

The deficit, which was the first since 1998 when SAFE started to publish the data, had aroused concerns about foreign investors pulling capital out of China. But, as I have argued many times earlier, it is essential to delve deeper into the numbers to see what really happened.

China employs two distinct sets of statistical methods to track foreign direct investment: one within the balance of payments framework by SAFE and the other by the Ministry of Commerce. The former encompasses both equity investments and intercompany debts, offering a more comprehensive perspective, whereas the latter excludes intercompany debts.

As a result, the BOP-based FDI data set has a broader scope and tends to exhibit greater volatility. It is not advisable to extrapolate FDI trends solely from individual quarterly data, nor is it appropriate to equate negative net FDI figures with foreign capital withdrawal.

China's BOP-based FDI surplus stood at $33 billion in 2023, down 81.7 percent year-on-year. The surplus in equity investments decreased by $97.5 billion, contributing to 66.3 percent of the total decrease in FDI surplus, while the deficit in intercompany debt transactions increased by $49.6 billion from the previous year, accounting for the remaining 33.7 percent of the overall decrease in FDI surplus.

It is obvious that the significant volatility in intercompany debt should not be equated with foreign capital withdrawal.

As for the decline in equity investment, it still merits further discussion — whether it is the result of a decrease in new foreign equity investments, capital withdrawal by existing foreign investors, or a reduction in reinvestment of undistributed profits due to declining profits of foreign enterprises.

In terms of China's FDI stock, as of the end of the third quarter of 2023, the figure stood at $3.345 trillion, with foreign equity investments accounting for $3.0397 trillion, down by $353.4 billion and $334.8 billion, respectively, from the peaks recorded at the end of the first quarter of 2022.

However, non-transaction factors, including exchange rate fluctuations and asset price revaluations, had led to cumulative write-downs of $447.8 billion for total FDI stock and $449.4 billion for foreign equity investments, respectively, from the second quarter of 2022 to the third quarter of 2023.

The write-downs had exceeded the total decreases in total FDI stock and foreign equity investments, indicating that the FDI stock decreases are attributable to the negative valuation effect, not real capital outflow.

The writer is global chief economist at BOC International.

The views do not necessarily reflect those of China Daily.