Hopes of stable stock market rise on H1 data

Over 850 of 1,600-plus firms forecast higher profits, with electronics leading

The improving half-year profitability of A-share companies can be interpreted as an indication that stock market performance will further stabilize in the following months and, more importantly, China's economic transformation will advance, said experts on Thursday.

Of the 1,600-plus A-share companies that have disclosed their first-half earnings forecasts so far, more than 850 said their income will rise year-on-year, according to market tracker Wind Info.

More than 350 companies anticipate their first-half net profit to rise over 100 percent year-on-year, while another 240 reported that they expect their net profit to rise by 50 percent to 100 percent.

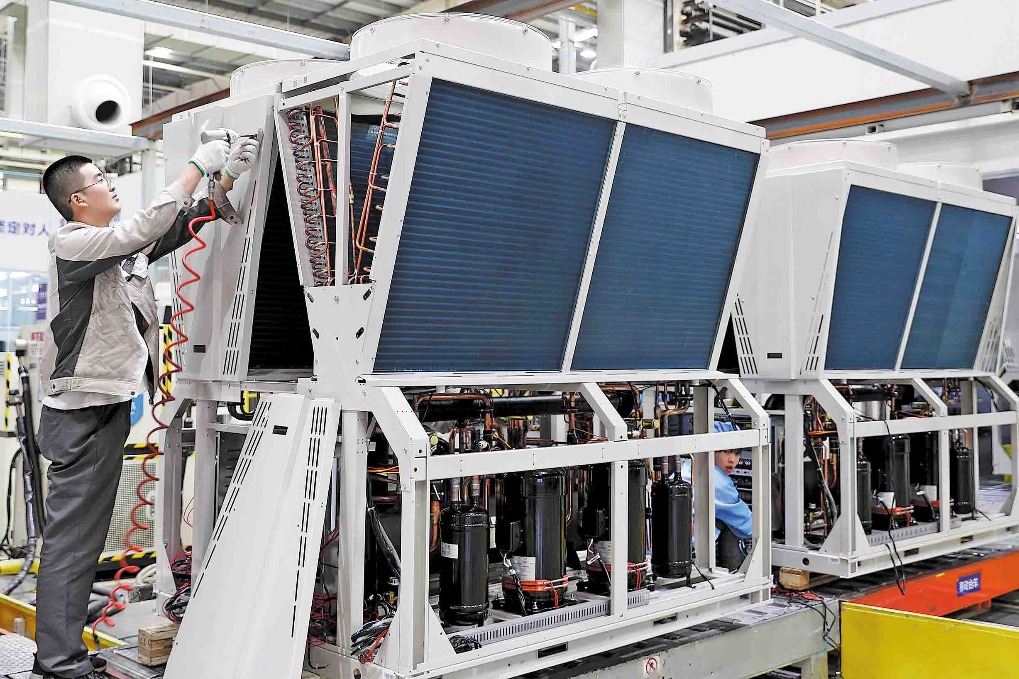

The electronics sector showed the strongest gains. At least 88 A-share companies from the sector reported net income increases in the first half. Chemical companies, engineering equipment providers and carmakers followed in terms of net income increase growth rates.

Of the 45 semiconductor companies that released earnings forecasts, 39 reported growth in the first half. Seven companies reported net profit increases of over 500 percent year-on-year, including industry big names such as Will Semiconductor and Montage Technology.

Analysts from Ping An Securities said semiconductor companies have abundant orders now, thanks to improving production globally and the rapid increase in domestic substitution. As industry leaders continue to invest in artificial intelligence-powered devices, chips have to be upgraded accordingly, which may lead to a new round of device replacement demand.

Data from the National Bureau of Statistics showed that the output of China's integrated circuit products increased by 28.9 percent year-on-year in the first six months.

Apart from semiconductor companies, improving profitability can be widely seen in the technology sector, including the computing power industry chain, the intelligent driving industry chain and consumer electronics, according to Chen Guo, chief strategist of China Securities.

The external reasons for the improving profitability vary, including the recovery of the overall industry and market demand, said Chen Li, chief economist of Chuancai Securities. But it can also be seen that technologies are making a bigger difference, with high-value-added sectors such as IC, robots and new energy vehicles showing stronger growth momentum, he said.

Qiu Xiang, joint chief strategist at CITIC Securities, said there were mainly two sets of A-share companies reporting better profitability in the first half. First, the upstream resource providers supported by rising prices, such as nonferrous metal and power suppliers. Second, manufacturing industries, which are export-oriented or show a better supply-demand relationship. Electronics companies and carmakers fall into the latter category.

"The profitability of A-share companies can reflect the transition of old to new economic drivers going on in China right now. Industries are gradually replacing the property sector to become the new source of growth," he said.

It is for this reason that companies along the real estate industry chain or manufacturing companies confronting intensified competition have reported poorer first-half earnings forecasts. Profitability improvement of more A-share companies may still take some time, said Qiu.

Looking ahead, A-share technology companies, especially with self-reliant technology expertise, as well as export-oriented companies, may post better performance in the following months, said experts from China International Capital Corp Ltd.