Economists: China impacts global economy

Updated: 2013-09-05 07:43

(China Daily)

|

|||||||||

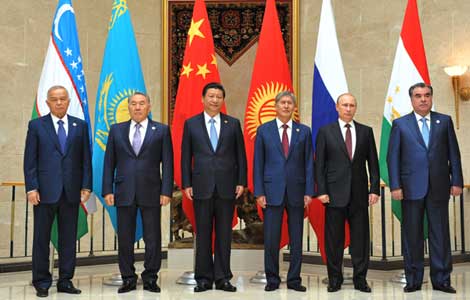

Editor's note: As policymakers of the G20 nations meet on Thursday in the Russian city of St. Petersburg for the eighth time, one issue that cannot be ignored will be the growth of China, the world's second-largest economy. Given its growing economic clout and considering its contribution to the global economy, it is necessary to have a closer look at how the Chinese economy will impact other major economies and how it will evolve. China Daily interviewed three economists for their views.

Q1: What kind of impact do you think China's economic slowdown will have on other economies in the world?

Q2: How will China's economic transition affect other countries?

A1: China's growth has witnessed an obvious deceleration from its double-digit rate of previous years, but it's only been a mild slowdown from last year, which suggests that the changes in the economy are under control.

If growth continues to decline in the world's second-largest economy, developed economies will be disappointed because they'll be worried that their economies will suffer from China's slowdown.

But China should still maintain a growth rate above 7 percent until 2020 and it will continue making stable contributions to the global economy.

As for emerging economies, China's weakening demand for commodities has partly affected their exports of resources, but a bigger worry for these economies would be if the United States tapered off its quantitative easing measures, which would alter the direction of global capital flows.

A2: In a way, China's transformation is reshaping the division of global labor.

In the past, China's exports were mainly low-end processing products, but more and more of these cheaper products are being manufactured in neighboring countries where there are lower labor costs. China is now introducing more research and development divisions and other high value-added sectors from developed economies, which is furthering its industrial evolution.

China's outbound investment is expected to exceed $90 billion this year and will soon surpass its annual inbound volume, making it a country with net capital outflow. A lot of these outflow investments will land in emerging economies.

But to prevent a reversal in China's economic transformation, the nation must change its local governments' obsession with GDP and create a fairer environment for market competition.

A1: Regionally, China's slowing growth will reduce prospects for export-led growth. It will also adversely impact commodity trade with major trade partners. Take, for instance, the role of Brazil. When President Luiz Inacio Lula da Silva took office in the early 2000s, Brazil was ailing and China had just joined the World Trade Organization. During his two terms, Brazil sold commodities to China, which supported the mainland's growth, while allowing Lula to reduce poverty in Brazil. Today, President Dilma Rousseff is trying to expand the Brazilian middle-class, but the country will not benefit that much from Chinese demand.

A2: China's slowing growth means different things in different parts of China. Industrialization and urbanization is actually accelerating in China's inland and western regions, while the shift to services and innovation is escalating in the more prosperous coastal regions. Those foreign countries that understand this dynamic and can adjust to it regionally will continue to reap benefits. Trade and investment is shifting within China, not necessarily out of China.

Moreover, in the past, foreign investment used to come primarily to China. Now these flows are riding a two-way street as Chinese companies are entering world markets. In the past, many nations benefited from cheaper prices in China. Today, many nations can benefit from the inflow of Chinese foreign investment, which supports industrialization and poverty reduction in emerging and developing countries and also high-technology trade in advanced economies.

A1: There is indeed an economic slowdown in China and in other emerging markets, but changes in market sentiment are what have really astonished me.

In early 2010, we had a batch of visiting international investment banks and funds, all of which were bullish on the Chinese market. No one would listen to the problems in the Chinese economy we discussed at that time. (China's GDP growth began retreating from its high of 10.4 percent after 2010.)

This year, all of the visiting foreign investors have been pessimistic about China. They do not believe that China's economy will not see a "hard landing".

What do they believe? They believe in expected changes. If all the people say you are doing poorly, even if you are doing well, you'll be doomed anyway. This is the logic of the market, or the "self-fulfilling prophecy".

A2: The original growth model for emerging markets such as China is coming to an end. We have to make a fresh start.

The rise of emerging markets is largely dependent on the golden age of globalization, which lasted about 20 years before the US financial crisis hit. During this period, the rapid growth in developed economies generated huge demand, which led to an export boom in emerging markets.

But since the outbreak of the financial crisis, developed economies have tried to revive their own manufacturing prowess and they are no longer welcoming imported products from emerging markets. Developed economies have withdrawn funds from emerging markets to fill their own needs, resulting in declining foreign investment in the developing world.

Consumption and investment are both suppressed in developed economies, reducing the demand for exports from emerging markets.

(China Daily 09/05/2013 page3)

Schedule