This financial push is for real

The economic sector that produces goods and services coasts on innovative help from commercial banks, other financial institutions

Away from corporate spotlights, without seeking to hog the limelight, China's financial institutions are quietly bringing about a revolution in the way crucial funding reaches the real economy.

Ever since President Xi Jinping said, during the two-day National Financial Work Conference in July, that serving the real economy is the duty and purpose of FIs, innovative lending has accelerated, bolstering the part of the economy that produces goods and services.

The scope of this financial renaissance extends far beyond the shores of China.

An outstanding example can be found on the Caribbean island of Jamaica.

On Oct 6, Alpart's alumina processing plant, which was resurrected by a Chinese company, produced its first alumina products in eight years.

Owned by the Alumina Partners of Jamaica, or Alpart, the plant was formerly under United Co Rusal PLC, a Russian aluminum producer, which closed it in 2009 due to losses caused by a decline in demand for alumina and a sharp rise in costs.

It remained closed until June 21 when Jiuquan Iron and Steel (Group) Co, or JISCO, bought it out from Rusal for $299 million (254 million euros; £226 million) last year and reopened it to turn it around.

The acquisition was made possible by a $170 million loan that JISCO received from the China Development Bank, a Beijing-based development financial institution.

It was as if the CDB had anticipated President Xi's call to strengthen the financial sector's capabilities to serve the real economy, which he gave at the 19th National Congress of the Communist Party of China last week. That call followed his directive earlier that FIs should channel more resources into major areas and weak segments of economic and social development.

Thanks to the acquisition of Alpart, JISCO's aluminum smelting subsidiary in Gansu province will receive 1.65 million metric tons of alumina annually for electrolytic aluminum production.

Yu Zhipeng, senior manager of the general affairs department of JISCO Alpart Jamaica, says: "Apart from raw material supply, the acquisition of Alpart will drive the domestic alumina market, which is picking up gradually. It will also promote cooperation between JISCO and potential partners in Jamaica by introducing advanced Chinese technologies to Jamaica and leading China's alumina-related industries to the Caribbean country."

The CDB served as a liaison between JISCO and the government of Jamaica, conducted research and coordinated on-site investigations before the takeover.

In addition to the first loan, the bank pledged a further $150 million to help Alpart restore production and improve its production capacity.

After the acquisition, JISCO started developing an industrial ecosystem in Jamaica involving a new industrial park, where a wide range of products, including 3.65 million tons of alumina, 450,000 tons of electrolytic aluminum and 600,000 tons of cement, would be made, says Li Jianjiang, deputy managing director of the CDB's Gansu branch.

"Total investments in the industrial park are expected to go beyond $2 billion, and the CDB will take the lead in providing financing for its construction," Li says.

Just like the CDB, many other banks, large and small, have stepped up support for the real economy.

For instance, China Construction Bank, the nation's second-largest commercial lender by assets, offered a $11.2 million loan to Zhongpin Food Co, an agricultural product processer and food manufacturer in Henan province, via a cross-border financing service.

Ben Baoke, director of Zhongpin Food, says, "The service helped lower our annualized financing cost by 40 basis points to 3.95 percent, compared with the one-year benchmark lending rate of 4.35 percent during the same period."

In addition to lending, CCB took various measures to support the food manufacturer.

CCB International (Holdings) Ltd, an investment services company owned by the bank, contributed 130 million yuan ($20 million; 17 million euros; £15.2 million) to a contract fund that invested in the equity of Zhongpin Food, paving the way for the company to list on China's A-share market.

The bank also offered online financing services to high-quality upstream and downstream companies that set up shop on the e-commerce marketplace of Zhongpin Food.

CCB also connected its online banking system with the enterprise resource planning system of the food manufacturer. It built a supply chain management and financial service platform by integrating information resources of both parties.

CCB again innovated its financial backing practices to help BYD Co Ltd, a Shenzhen-based electric car maker.

Last year, CCB underwrote BYD's perpetual bonds that were issued for 400 million yuan in China's interbank bond market with 5.1 percent coupon. With the proceeds, BYD sought to repay bank loans and satisfy its medium-and long-term capital needs.

As one of the underwriters, CCB helped BYD file the application for bond issuance and communicate with credit rating agencies and institutional investors in the interbank bond market, in addition to providing financial advisory services.

Alpart, Zhongpin and BYD are but three examples of how the real economy players have been benefiting from the banking sector's renewed financial push.

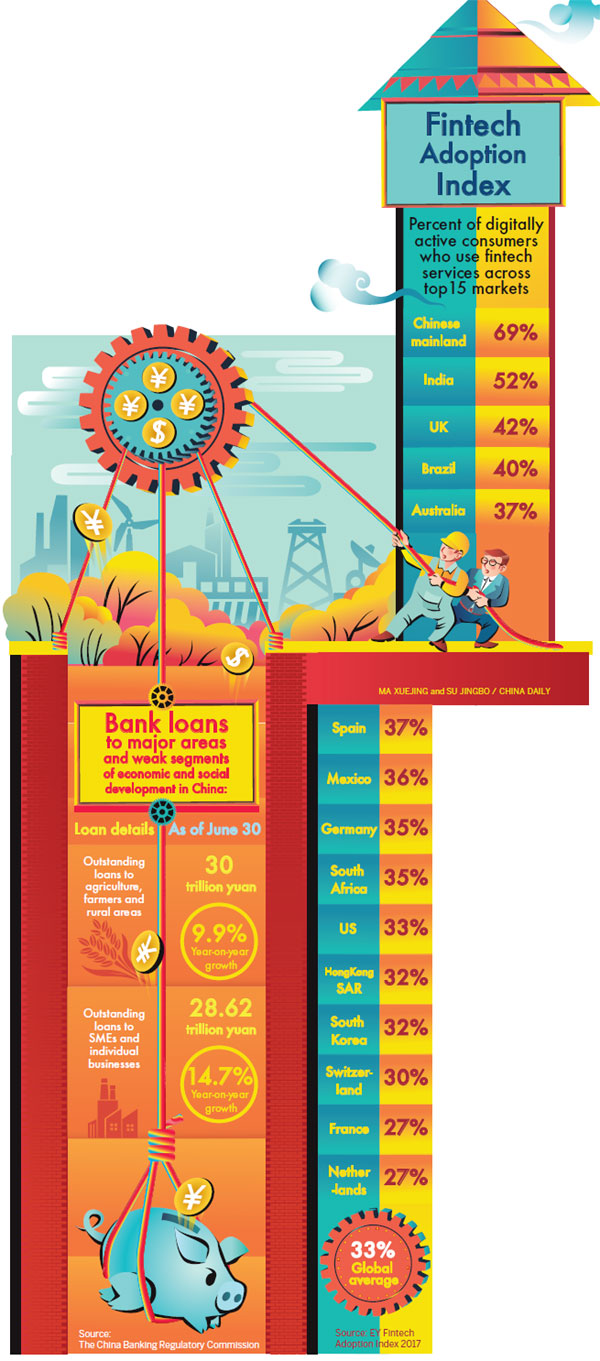

As of June 30, outstanding loans related to agriculture, farmers and rural areas increased by 9.9 percent year-on-year to 30 trillion yuan.

Outstanding loans relating to small and micro enterprises, and individual businesses, rose by 14.7 percent to 28.62 trillion yuan, according to the China Banking Regulatory Commission.

Banking regulators and local governments have launched policies to encourage banks to give stronger support to the real economy.

Consequently, technology startups with high growth potential benefited.

For instance, the Suzhou municipal government founded a 1 billion yuan credit guarantee fund to help asset-light, innovative companies at an early stage of development obtain bank loans more easily.

Using the credit guarantee fund, a qualified company can apply for a loan of up to 5 million yuan for a term of six months and above without any collateral.

If a company defaults on a bank loan, the fund will share 65 percent of the loan loss along with the bank (20 percent) and relevant guarantee or insurance companies (15 percent).

May Hap Industrial (Suzhou) Co, a small biomedical company that has multiple patents on inventions, obtained a one-year loan of 2 million yuan from the Suzhou branch of China Everbright Bank with the help of the credit guarantee fund.

Han Lijun, general manager of May Hap Industrial, says: "As a startup, our company's core value is patented technologies and a research team. In the past, we could not get credit from many banks due to lack of physical collateral. Although some banks were willing to give us a loan, the lending rates they set were much higher than the central bank's benchmark lending rate, and we couldn't afford it."

China Everbright Bank granted a loan to Map Hap at a lower rate. The money was mainly spent on research and development of equipment and laboratory facilities, Han says.

jiangxueqing@chinadaily.com.cn

(China Daily Africa Weekly 10/27/2017 page26)

Today's Top News

- Cultural events marking victory against Japanese aggression unveiled

- Wang Yi holds talks with Belgian FM Maxime Prevot

- European Commission president meets with Wang Yi

- Beijing calls for enhancing communication with EU

- Ministry warns of flood risk in north, drought in south

- Green energy powers Indonesia ties