US stock market craters amid talk about a recession

The US stock market on Monday showed how it felt about recession talk over the weekend — by heavily selling off.

Monday was the worst day yet in which the S&P 500 has swung 1 percent up or down — seven times in eight days in reaction to US President Donald Trump's on- and off-again tariffs.

Asked whether he was expecting a recession in 2025, Trump told Fox News in a Sunday broadcast: "I hate to predict things like that."

US Treasury Secretary Scott Bessent has said the economy may go through a "detox" phase as the administration looks to slash government spending.

The Nasdaq Composite fell by 728 points, or 4 percent, on Monday, while the S&P 500 fell 156 points, or 2.7 percent, to send it close to 9 percent below its all-time high, which was set last month. The Dow Jones Industrial Average declined by 890 points, or 2.1 percent, after paring an intraday loss of more than 1,100 points.

Bitcoin also hasn't provided a refuge for investors. The cryptocurrency's value as of Monday had dropped below $80,000, from more than $106,000 in December.

"This is the first time we've had an administration pretty much say with a straight face … the objectives are going to cause pain," said Shelby McFaddin, investment analyst at Motley Fool Asset Management, to The Wall Street Journal.

"There are always multiple forces at work in the market, but right now, almost all of them are taking a back seat to tariffs," said Chris Larkin, managing director at E-Trade from Morgan Stanley.

David Bahnsen, the chief investment officer at the Bahnsen Group, also sees tariffs as the cause of the market's roiling — but mainly because investors can't figure out what the end game is.

"The market volatility is much less about the bad news of tariffs and much more about the uncertainty of tariffs, especially uncertainty as to what the policy is, where it is headed, how long it will last and what the end result will be," he told The New York Times.

There are more tariffs in the pipeline.

Starting Wednesday, the Trump administration plans a 25 percent tariff on all US steel and aluminum imports. There is also the prospect of reciprocal tariffs on all US imports, to mirror other countries' tariffs, effective April 2.

"The desire to believe in American exceptionalism is very strong," said Matt Rowe, head of portfolio management at Nomura Capital Management, to the Journal. "The reality is that if we're doing everything on our own, everything is going to be a lot more expensive."

Trump met on Monday with tech industry CEOs, but the event was closed to the news media. He didn't comment about the selloff while the market was open.

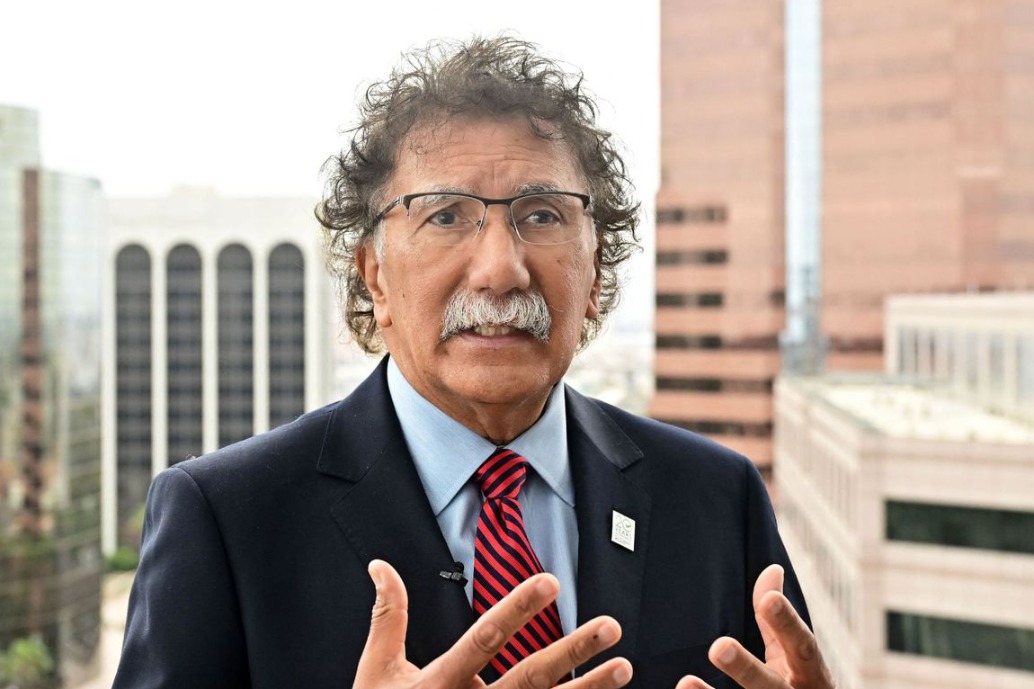

Michael Rosen, chief investment officer of Angeles Investment Advisors, told Bloomberg: "It took a few weeks for Trump to break the international economic regime, presumably with a plan to fix and replace it with something 'better.' Absent a clear idea of what 'better' is, investors are just left with the detritus of the broken global economic framework. Unless and until we see what replaces it, investors will be cautious, at best."

At Goldman Sachs, analyst David Mericle cut his estimate for US economic growth to 1.7 percent from 2.2 percent for the end of 2025 over the previous year, largely because tariffs look like they'll be higher than he was previously forecasting.

But Mericle said he sees only a 1-in-5 chance of a recession over the next year, raising it only slightly because "the White House has the option to pull back policy changes" if risks to the economy "begin to look more serious".

On social media, some speculated that the selloff was part of a plan.

"The US government has to refinance $7 trillion of debt in the next six months.

There is no way TRUMP wants to refinance it at current 10-year yields so this is why he wants (the) stock market to crash (to) pump the bond prices," wrote Ash Crypto to 1.7 million followers on X. "As bond prices will go up, yields will come down and the US government will be able to refinance their debt at cheap rate. Not only that, lower bond yields will also push the Fed to do rate cuts, which is bullish for risk-on assets (such as stocks and real estate)."

Charles Gasparino, a Fox Business senior correspondent, wrote on X: "One thing to keep in mind with the markets correcting: there were only a handful of stocks that pushed the indices higher and to their records. They were bound for a correction and tariffs are the trigger because there is always a triggering event that changes the direction of the herd."

Agencies contributed to this story.

hengweili@chinadailyusa.com