US tariffs invites reciprocal action, creating uncertainty

The United States appears to be using tariffs to seek reciprocity in its trade relations, in a bid to reduce its trade deficit. In our (Morgan Stanley's) view, this poses challenges for Asia, given that seven of the top 10 economies with the largest trade surpluses against the US are in Asia.

It also adds uncertainty to the business cycle, as we expect trade tensions to weigh on corporate confidence, affecting capex and trade.

In efforts to guess what exactly US President Donald Trump will announce on Wednesday in the form of global reciprocal tariffs, some details have emerged about what he could seek from the US' trade partners to reduce its trade deficit.

First, the US could ask its trade partners to increase purchases in a bid to reduce their trade surplus. This may be possible for some economies, but for others the size of their trade surpluses with the US as a percentage of their respective GDP will pose a challenge. For instance, Thailand's trade surplus with the US is 10 percent of its GDP, while Vietnam's is 25 percent of its GDP.

Meanwhile, other Asian economies like India and the Republic of Korea, whose surpluses are smaller as a percent of their GDP, have already indicated plans to increase purchases of oil and gas, civilian aircraft and defense equipment from the US.

Second, the US administration has been asking economies with trade surplus to hike their defense spending. In a way, this is related to the first, as a higher defense budget is a channel through which some Asian economies can reduce their trade surplus with the US. Given Japan and the ROK are already importing 90 percent or more of their arms from the US, an increase in defense spending will likely result in more arms imports from the US.

For other Asian economies, the share of the US' military-industrial complex in their defense imports is much lower. As such, they can consider increasing their defense purchase from the US. As for some Asian economies that already planned to raise their defense spending, the US may ask them to further hike their defense budget. Some countries may find it extremely challenging to fulfill the US' new requirements, because their public debt ratios are higher now and they've already encountered domestic political pushback against increasing their defense spending.

Third, some countries can reduce their trade surplus by lowering tariffs on US imports, but the World Trade Organization's most-favored-nation principle prevents economies with higher tariffs on US imports from doing so without extending the "lowering tariffs" to other WTO member economies, unless it is done under a free-trade agreement. And negotiating free trade agreements will take time — it is unlikely to be completed before the US raises tariffs. India, for instance, is negotiating a trade deal with the US, but the first tranche is expected to be completed only in the fall.

And fourth, the administration could ask Asian economies to match US tariffs on China as one of the conditions for granting concessions in any trade deal. With the exception of India, the US tariffs on other Asian economies are not as high as those imposed on China (about 30.9 percent following the imposition of an additional 20 percent tariffs). Given this fact, matching the US in tariffs on China will imply significant tariff increases.

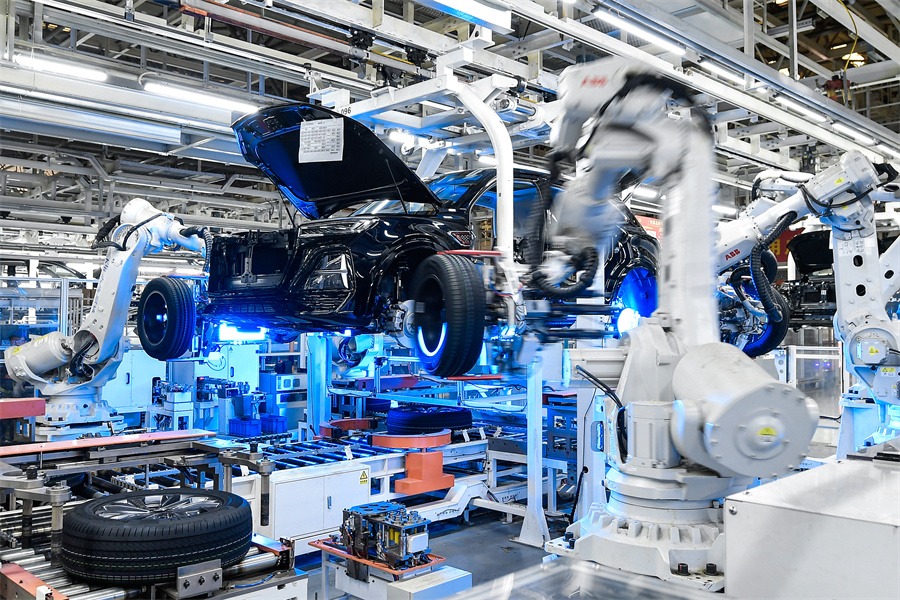

In our view, such conditions will pose significant challenges to other Asian economies given China's deeply embedded role in the manufacturing global value chain. China accounts for 41 percent of the world's global value chain-related output in the manufacturing sector (defined as manufacturing output of a country that directly or indirectly crosses more than one border), highlighting its high global value chain participation.

Moreover, Asia has a large cross-border production network with deep trade linkages among economies. From a practical standpoint, most of the economies in the region are either dependent on China as a key source of end demand or China is a key supplier to them.

The bigger challenge that Asia faces is that, tariffs or no tariffs, we have now entered a period where uncertainty is weighing on corporate confidence. The persistence of trade tensions will weigh on corporate confidence, capex and trade, and this will be the dominant channel through which the growth effects will transmit. Against that backdrop, we continue to believe that the economies most affected will be those with a higher trade orientation.

There is room for both monetary and fiscal policy to respond as the growth drag materializes. Fiscal easing will be more effective against this backdrop because it directly supports aggregate demand. But high levels of public debt at the starting point along with political issues may constrain the extent of fiscal stimulus.

The heavy lifting would therefore have to be done through monetary easing. Indeed, compared with 2018-19 when trade tensions emerged, we expect central banks to cut rates more this time around. We also expect the mix of easing to be tilted more toward monetary than fiscal, unlike fiscal over monetary back in 2018-19. Overall, however, we don't expect policy easing to be able to fully offset the growth drag that emerges from trade tensions.

The author is the Chief Asia Economist at Morgan Stanley.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.