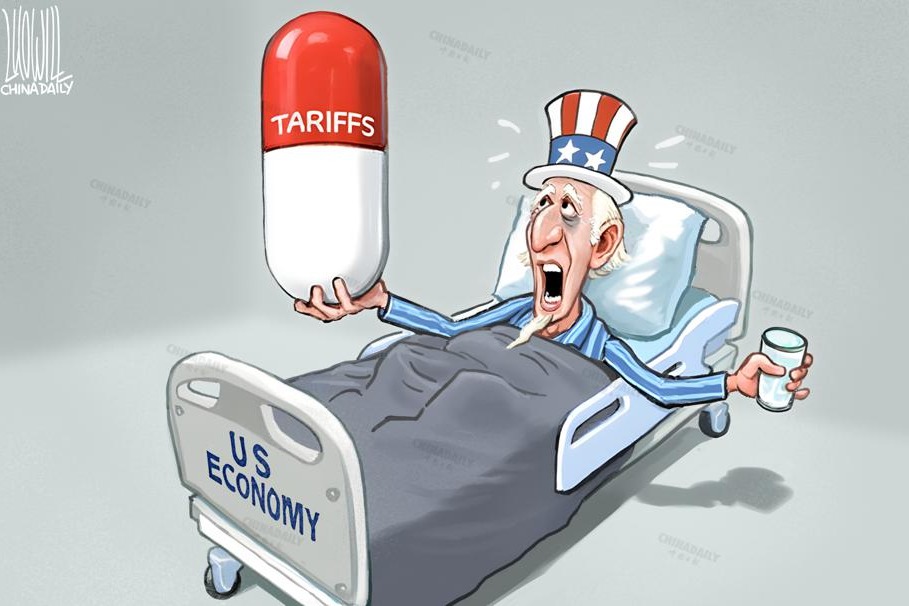

White House has to make tariff retreat

President Donald Trump is highly attuned to stock market trends and consistently monitors its responses to the government's political and economic actions. Unfortunately for him, global markets have continued to tremble at his tariff policy. This occurred even after Trump announced a significant 90-day deferral on the imposition of additional tariffs on all countries — except China. The market's behavior reflects global sentiment regarding a potential trade war with China.

Both direct and indirect information suggest that the US sovereign bond market was the primary reason for the Trump administration's change in position. In one day, the effective interest rate surged to 5 percent. Since such changes should not occur with such chaos, many experts believe that the president's retreat was a direct response to the negative dynamics of the debt market. The last time this happened was during the "Dash for Cash", a crucial moment of financial instability at the onset of the pandemic in March 2020. What has occurred in the debt market has exposed the vulnerability and weakness of the US administration's position.

The bond market's behaviour indicates that US impulsive tariff policies are damaging markets. Treasury Secretary Scott Bessent seems to have urged Trump to negotiate trade deals with his allies before addressing the China issue.

The United States has previously labeled even its closest allies as robbers, swindlers and marauders. Consequently, the US retreat from the initial tariff tactics underscored that this was simply bullying and a hooligan bluff, not a well-thought-out strategy.

Deeply alarmed by the behavior of the markets, Trump quickly backtracked, stating in a televised Cabinet meeting that "there will always be transition issues" and "difficulty".

Beijing has shown no signs of backing down, raising its retaliatory additional tariffs to 125 percent on US goods.

Trump's puzzling chess game has excluded China from the tariff war easing. If the situation remains unchanged, the Chinese economy will encounter significant challenges regarding restricted access to the US market.

Despite this, Trump expressed hope for a deal with China. "I think we'll end up with something that will be very good for both countries. I'm looking forward to it," he said.

Even after the initial draconian measures were rolled back, the US administration created a vast protectionist tariff barrier not seen since the 1930s. The world faces a universal 10 percent tariff, regardless of whether a country has a trade deficit or surplus with the US. For instance, countries such as Australia, the Netherlands, the United Kingdom, and the United Arab Emirates purchase more goods and services from the US than they sell to it.

Today's central problem in the global economic order is that the US policies are pitting the world's two economic superpowers that have complementary economies against each other. Tariffs at these exorbitant rates are a massive blow to business between countries whose trade volume constitutes about 3 percent of global trade. The lifeblood of the worldwide economy could come to a halt.

The consequences of all this will become clear very quickly. Prices may rise in both countries, manufacturing plants could be jeopardized, and people might lose their jobs. Goldman Sachs recently estimated that introducing new tariffs could reduce Chinese GDP by 2.4 percent. However, at the same time, China can mitigate such challenges through government support; such leverage does not exist in the US, as the economy is almost entirely private, and the government possesses no direct leverage.

Recently, the world has been taken aback by how the US administration has struggled to explain the introduction of tariffs on modest imports from impoverished African countries, the alteration of tariff rates before their implementation, and the mistakes in their calculation methods.

Now, even the closest US allies no longer trust the US administration, which first issues shocking statements and decrees and then cancels and adjusts them with the same high-handedness. Ordinary citizens worldwide ask: What can be agreed upon with this US? Before our eyes, the atmosphere of trust in the world's most powerful state is rapidly deteriorating.

Perhaps the world should begin crafting a new global order, setting aside Washington and its unpredictability and fantasies.

The author, former prime minister of the Kyrgyz Republic, is a professor at the Belt and Road School of Beijing Normal University.

The views don't necessarily represent those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.