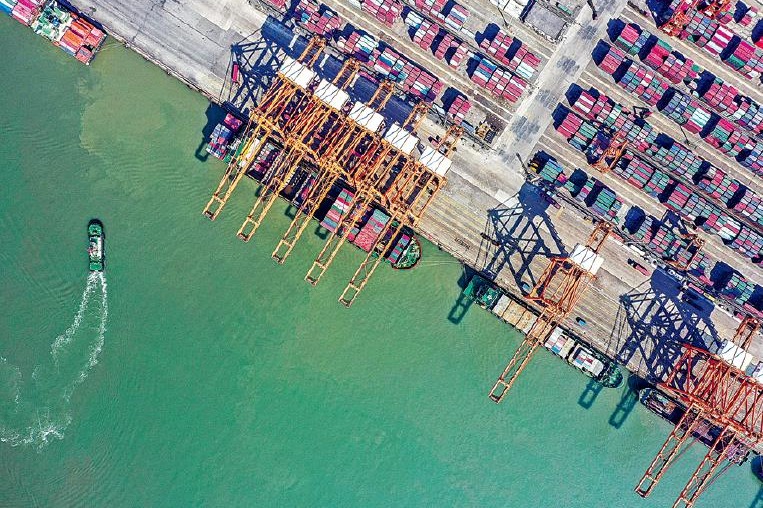

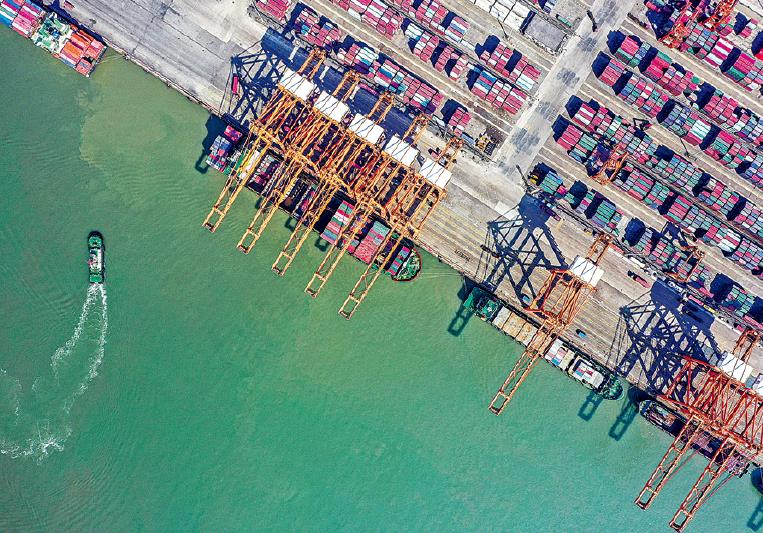

Asia-Pacific facing disruption of value chain

Policy uncertainty reigns supreme since the United States' "Liberation Day" when it unveiled sweeping tariffs on April 2 while introducing a two-tier tariff regime comprising a 10 percent universal baseline tariff and elevating country-specific tariffs of up to 50 percent, targeting 57 countries — including many in the Asia-Pacific. Although the country-specific tariffs were suspended for all countries except China on April 9, subsequent signals have been mixed. While product exemptions were expanded to include certain electronic goods, the US also launched new Section 232 investigations into imports of semiconductors and pharmaceuticals. These developments suggest the potential for further unilateral trade actions and underscore the persistent uncertainty in the global trade environment.

These shifting trade dynamics carry important implications for the Asia-Pacific, where deep integration into global value chains — characterized by high reliance on imported inputs — intensifies both direct and indirect exposure to the US' evolving tariff measures.

Direct exposure occurs when a country's exports to the US are directly subject to tariffs. The actual burden can be heavier than the announced tariff rate because tariffs are applied to the full shipment value, even when much of it comes from imported inputs. For example, only $51.5 of Cambodia's $100 textile shipment to the US is domestically produced. A 10 percent tariff on the full value translates into an effective 23 percent tax on Cambodia's actual contribution. The Economic and Social Commission for Asia and the Pacific's Regional Integration and Value Chain Analyzer shows that while most Asia-Pacific economies are subject to the same 10 percent baseline tariff, many face an effective tariff burden exceeding 15 percent.

Indirect, or pass-through, exposure arises when a country exports intermediate goods or services that are later embedded in another country's exports to a tariff-imposing market. For example, in 2022, Bangladesh exported approximately $8.2 billion in textiles and textile products to the United States, with about one-third of that value derived from upstream trade partners. Notably, US firms themselves, along with firms in China, India, Pakistan, and Indonesia, are key contributors to Bangladesh's textile exports — getting indirectly exposed to US tariffs on those exports.

The impact of US tariffs is expected to vary across the Asia-Pacific. Economies with high direct export exposure — such as Vietnam, Cambodia and Thailand — could face significant trade-related contractions, with direct exposure accounting for 3 to 11 percent of GDP if the April 2 tariffs were reinstated. Indirect exposure through global value chains may also dampen growth in upstream economies supplying raw materials, parts and components. For example, Negara Brunei Darussalam, Mongolia, the Lao People's Democratic Republic, Malaysia, and Singapore could see indirect exposure equivalent to approximately 1 percent of GDP. In contrast, economies with larger domestic markets or more diversified export structures — particularly those with strong service sectors — are better positioned to absorb the trade shock.

For both policymakers and industry leaders, identifying the source of vulnerabilities is essential for crafting targeted and forward-looking responses. These strategies should not only aim at mitigating current risks but also strengthening long-term economic adaptability.

Evidence-based analysis is essential for guiding targeted support. Sectoral data highlights how Thailand is indirectly impacted through its upstream supply chain linkages with Vietnam. The most vulnerable among Thai manufacturing sectors are leather and textiles, food and beverages, and other light manufacturing, electrical equipment. This insight suggests that coordination between Thailand and Vietnam focusing on these industries could mitigate shared risks and enhance resilience.

Beyond bilateral efforts, regional coordination with supply chain partners is essential to address short-to-medium term challenges. This is particularly important because relocating supply chains requires long-term planning guided by infrastructure, labor, innovation capacity and regulatory stability — not just short-term tariff shifts.

Strategic uncertainty remains high too, as no country is fully shielded from tariff exposure. In the current unpredictable global trade environment, companies will remain cautious about investing or re-configuring supply chains.

Governments across the Asia-Pacific must be prepared to deliver tailored support to companies and workers as global value chains continue to evolve. Informed domestic and international policies require sector-specific assessments. In this context, ESCAP's TINA tariff simulator offers a valuable tool for preliminary assessment of Asia-Pacific tariff exposure.

Policy priorities include targeted support for affected small- and medium-sized enterprises and export-oriented firms; re-skilling and adjustment support for impacted workers; incentives to diversify exports and reduce market concentration; and bilateral and regional cooperation to maintain supply chain continuity.

Witada Anukoonwattaka is economic affairs officer, ESCAP; Yann Duval is chief of trade policy and facilitation section, ESCAP; and Rupa Chanda is director of trade, investment and innovation division, ESCAP.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.