Why global investors are betting big on China

"Here, green license plates outshine desert oases." Recently, streets in the Middle East have been decorated with "Chinese green." Chinese electric vehicles are taking the Middle East markets by storm, where one in every two new energy vehicles in Israel now bears a Chinese logo.

Half a world away, Deutsche Bank drops a bombshell report titled China Eats the World, its cover emblazoned with a bold subtitle "China's, not AI's Sputnik moment".

Global capital is also casting a vote of confidence for China. Goldman Sachs just hiked its CSI 300 target to 4,700. Even Morgan Stanley—once a vocal skeptic—has flipped its script, upgrading its rating on MSCI China to a more optimistic Equal Weight.

Behind this confidence is the tech-driven growth momentum of the Chinese market and strong policy support from the government.

Tech leapfrog: From benchwarmer to MVP

Global banks aren't just betting on China's size anymore—they're betting on its brains. The optimism starts with a significant progress in Chinese tech: once playing catch-up, now setting the pace.

"We think 2025 is the year the investing world realizes China is outcompeting the rest of the world," declares Deutsche Bank. In early 2025, China launched the low-cost artificial intelligence DeepSeek, marking a watershed moment of China cracking cutting-edge AI even under vigorous sanctions.

China's open-source models represented by DeepSeek are democratizing AI access. "It's like ChatGPT on a Walmart budget," said some users. "They're not just catching up—they're rewriting the rule book." From a trend follower to an industry leader, China's tech progress is not to be contained.

The success is not an isolated one. In 2024, The Chang'e-6 probe collected and brought back 1,935.3 grams of moon dust in what was the first-ever lunar far-side sampling mission in human history. The BeiDou-3 system launched two of its latest satellites, becoming a globally recognized satellite navigation system for civil aviation with centimeter-level positioning accuracy. China's production of new energy vehicles exceeded 10 million for the first time, making it the first country in the world to achieve this milestone. The AR-500 unmanned helicopter, a key project in the low-altitude economy, successfully tested its functions in multiple urban scenarios such as unmanned delivery and agricultural and forestry pest control.

In manufacturing, China has fostered clusters of industrial champions. Its performance in high-value-added fields and its supply chain advantages are expanding rapidly. Once a global factory of apparel, textiles and toys, and a leader in basic electronics, steel and shipbuilding, China now tops the world in high-speed rail technologies and complex telecommunications equipment.

The result? Chinese companies now stay ahead in global markets with products of top-tier quality and accessible prices. China's high-value innovation is reshaping the global manufacturing landscape.

For Deutsche Bank, this evolution from "cost-performance edge" to "technology premium" echoes Japan's 1980s rise—but only faster.

The message is clear: Forget "Made in China," the new mantra is "Invented in China".

Policy anchors: The market's stabilizing force

Foreign confidence also rests on China's favorable policies. The 2024 guideline on capital market regulation pushed listed firms to pivot from expansion to rewarding investors. As a result, a record 2.4 trillion yuan ($330 billion) worth of A-share dividends were paid out in 2024.

Simultaneously, regulators turbocharged long-term capital inflows, and scrapped caps on equity investments for pension funds, retirement funds and insurance.

"China's policy toolkit—fiscal, monetary and structural—is uniquely adaptive," notes Goldman Sachs. For global investors, Chinese firms now serve as safe harbors in choppy waters.

Actions over words: Capital making its move

Actions speak louder than words. Norway's Government Pension Fund Global (GPFG) boosted its China holdings by 50.8 billion yuan ($7 billion) in 2024. Goldman Sachs predicts that the MSCI China Index will surge 14% in 2025. And Michael Burry, the "Big Short" investor who predicted the 2008 crash, went all-in on Chinese stocks, increasing his holdings on Alibaba, Baidu and JD.com, Inc.

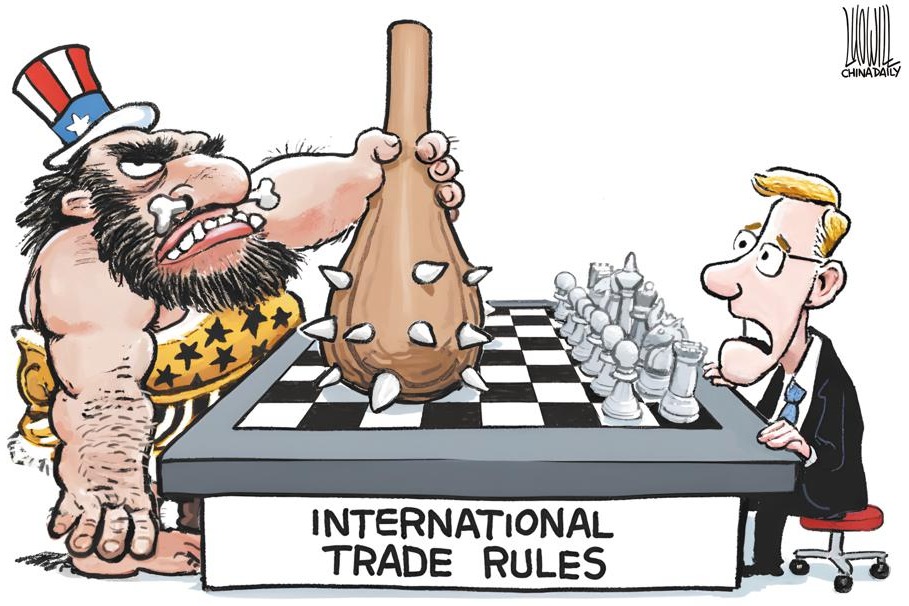

Of course, optimism also requires prudence. China's economic growth has entered a new normal of 5%, real estate debt risks have yet to be cleared, and geopolitical tensions have increased pressure on critical technologies like semiconductor chips.

But as Chinese wisdom goes, with risks come immense opportunities. When China's $18 trillion of household savings start to migrate to the capital market, when China maintains its 30% contribution to world economic growth, and when China's growth rate more than doubles that of most developed markets, the trend is unstoppable—whoever misses China now will miss the next golden decade. And amid this trend, one either rides the wave or gets left ashore.

The author is a commentator on international affairs.

The views don't necessarily represent those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.