Abusive port fees blackmail global shipping sector

What is the USTR's proposal?

On April 17, 2025, the Office of the US Trade Representative released the final notice of action regarding its investigation into what it called "China's unfair practices in the shipbuilding and maritime logistics sectors". With regard to the draft Federal Register Notice and the accompanying press release, the United States is set to levy fees on vessels arriving at US ports which are owned, operated or built by China.

This measure will be rolled out in two phases. The first is scheduled to begin on Oct 14. During this stage, the US will start charging fees which are calculated based on the net tonnage of arriving vessels. For ships with Chinese operators or owners, the fee will commence at $50 per net ton and gradually increase to $140 per net ton over a three-year period.

For Chinese-built ships, the fee will begin at $18 per net ton and increase to $33 per net ton within the same three-year span. The second phase will be initiated three years later. At that point, the US will place restrictions on the transportation of liquefied natural gas by foreign vessels, with these curbs intensifying incrementally until 2047.

The USTR Notice defined "Chinese ownership" in terms of legal title, beneficial ownership and effective control. Nevertheless, when it came to defining a vessel's "operator", the USTR simply referred to a US Customs and Border Protection form, which fails to offer a clear-cut definition of the term.

All these fees are imposed under the authority of Section 301 of the Trade Act of 1974. This section empowers the USTR to counter any foreign country's action which is considered "unjustifiable and burdens or restricts United States commerce". Evidently, such practices blatantly violate a fundamental tenet of the World Trade Organization system, the principle of non-discrimination under the Trade-Related Investment Measures.

This principle serves as the cornerstone of an orderly international trade environment. Imposing higher fees on vessels which are either owned, operated or built by China arriving at US ports is a discriminatory trade practice targeting China and other countries. It severely breaches WTO rules and significantly undermines the rules-based multilateral trading system and the international economic and trade order.

Moreover, the USTR's actions may also violate the 2003 Sino-US Maritime Agreement, as well as other US laws. For instance, the USTR's use of its Section 301 authority may be in violation of the export clause in the US Constitution. As a result, it is highly likely that affected stakeholders will challenge the legality and validity of these practices on administrative, constitutional and procedural grounds.

Although the US port fees are aimed at countering China's dominance in the shipbuilding industry, the general view is that they will not lead to a renaissance in US shipbuilding. US shipyards generally face limited capacity and a lack of price competitiveness. A container ship built in China costs approximately $55 million, while a comparable US-made ship comes with a price tag of around $330 million.

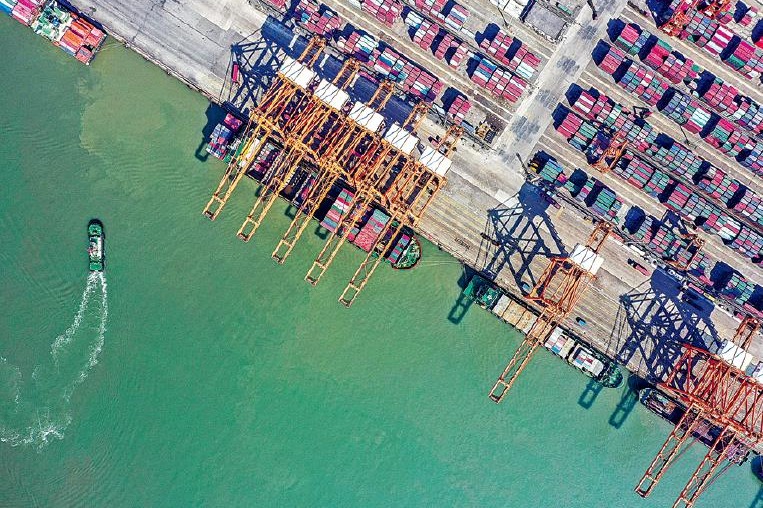

China holds the position of the world's largest shipbuilder. According to Clarksons Research's 2024 annual review of the shipbuilding industry, around 66 percent of all new ship orders placed in 2024 were awarded to Chinese shipyards, while the US accounted for a mere 0.1 percent. In terms of shipbuilding output, China commands a 53-percent market share, meaning that 53 percent of all ships delivered globally in 2024 were manufactured in China. Charging hefty port fees for vessels that have already been built and delivered by China and are owned or operated by Chinese or non-Chinese entities is meaningless in terms of revitalizing the US shipbuilding industry.

From a practical perspective, the measure may disrupt global shipping and ultimately harm US customers and businesses more than it impacts China. Decoupling with and penalizing Chinese shipping will only disrupt the US logistics system and its supply chains.

On the one hand, large shipping lines have significant fleets of Chinese-built vessels, and Chinese-owned operators transport vast quantities of goods to the US. On the other hand, data from Lloyd's List Intelligence shows that only 9 percent of Chinese-built ships called at US ports in the first quarter of 2024, which is a relatively small proportion. These shipping lines can redeploy their vessels to non-US services, reducing the number of Chinese-built ships visiting US ports. Eventually, US businesses and consumers will bear the brunt, facing higher prices as increased shipping costs drive up inflation, thus affecting importers, exporters and American households alike.

In conclusion, the USTR seems to have grossly miscalculated the importance of China in the global shipbuilding industry and its trade relations with the US. Targeting Chinese-built ships operated by global shipping lines that serve the US not only violates WTO rules and US laws, but is also detrimental to the interests of the United States and its people.

The author is a partner at Jin Mao Partners, a leading Chinese law firm. The views don't necessarily represent those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.